Q1 2021 Investor Sentiment Survey

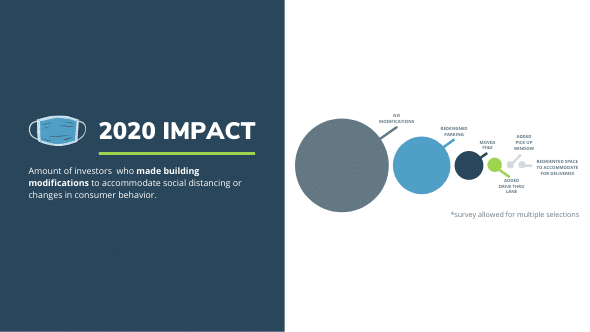

48% of investors surveyed made permanent modifications to their buildings in 2020 to accommodate for social distancing.

Retail Market Outlook

With vaccines providing some light at the end of the tunnel, the US economy is expected to enter a period of recovery in 2021. However, forecasting how the commercial real estate market will recover is difficult, especially as many physical stores remained closed.

To gain a better perspective from our network of professional retail property investors, Foresite Investment Sales conducted a survey during the 1st Quarter of 2021. The survey included active retail property investors and shopping center owners.

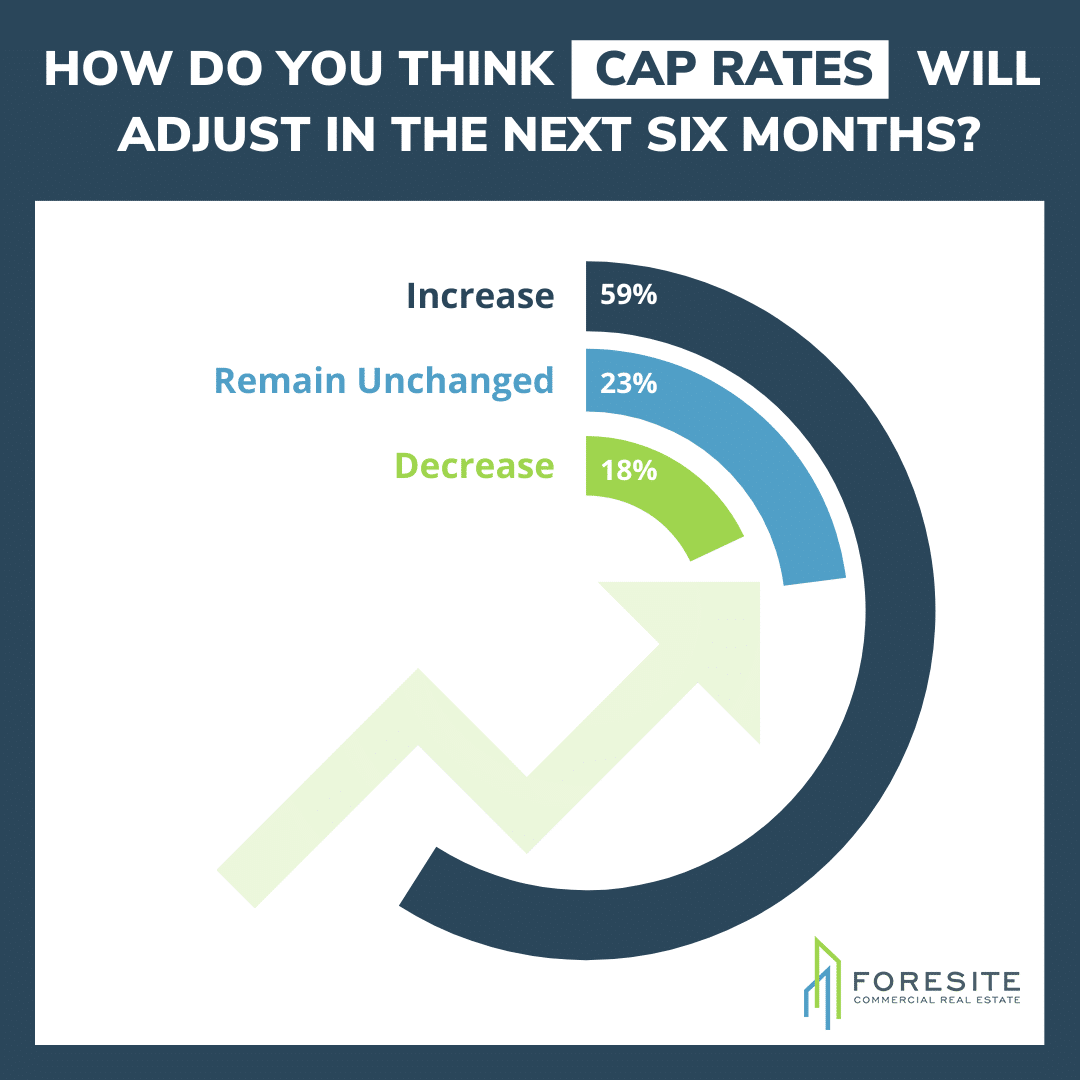

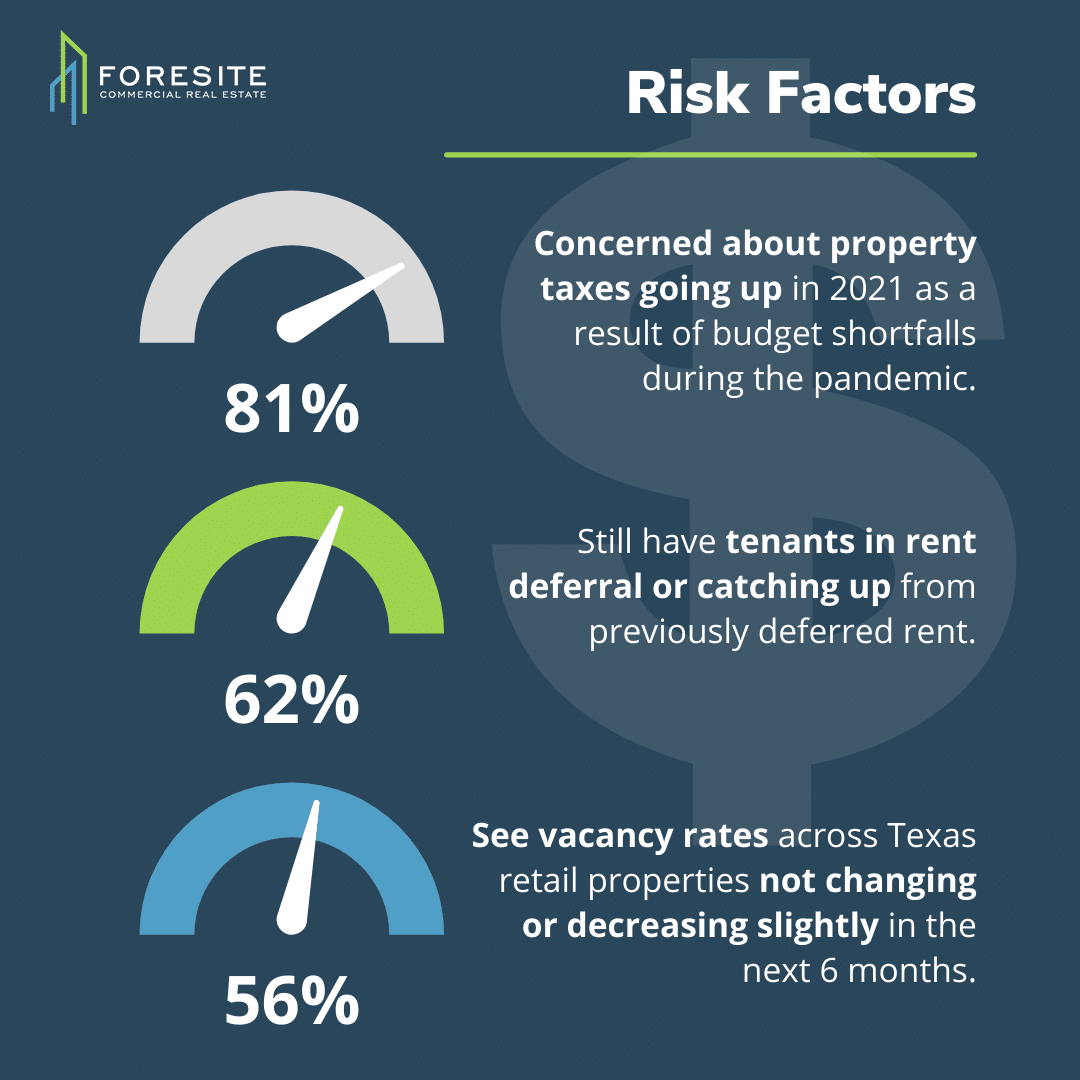

The majority (59%) of respondents believe cap rates will increase in the next 6 months.

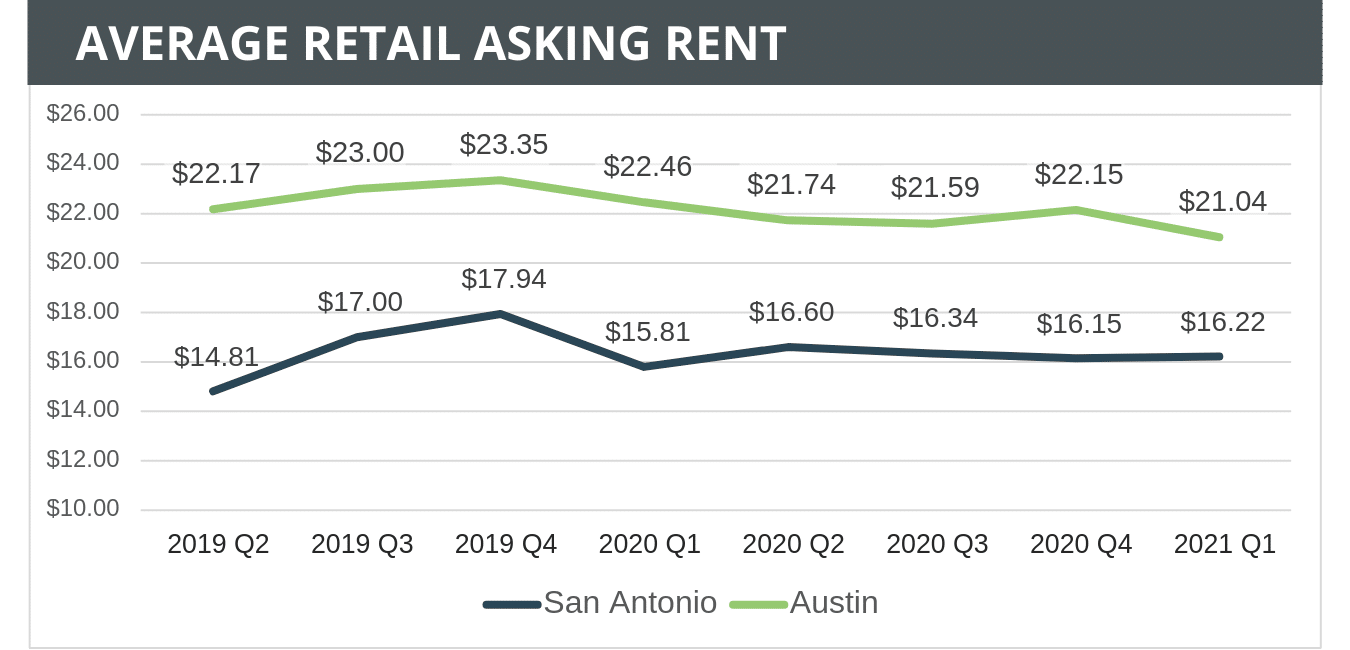

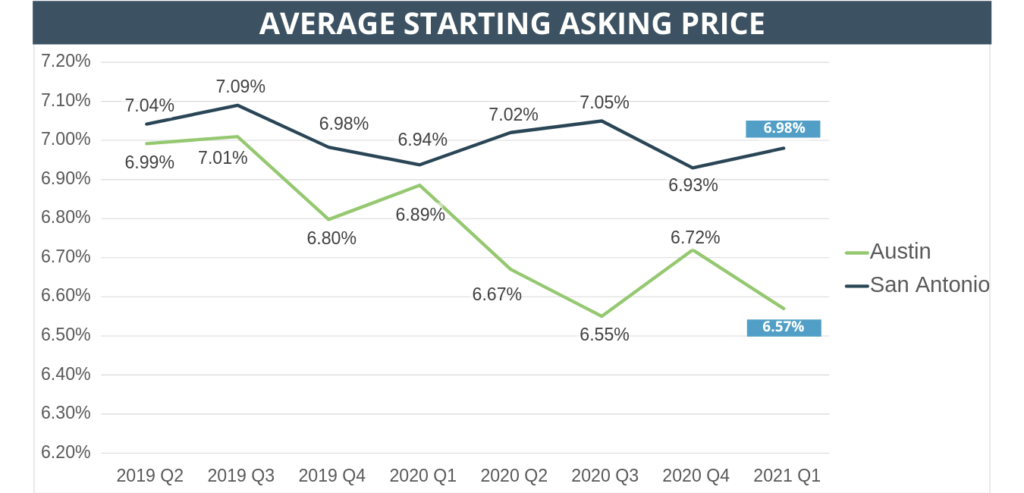

Asking Prices

The graph above shows the averages by quarter of the starting asking prices for multi-tenant retail listings on the market. The asking cap rates between Austin and San Antonio listings were very close during 2019 and into 2020 until the pandemic hit at the end of Q1. In 2020, we saw the average cap rate follow 2019 trends in San Antonio while the average in Austin decreased over thirty basis points. The asking cap rates in San Antonio have remained stable and averaged 7.00% over the last two years. The asking cap rates in Austin have continued to compress and average almost 50 basis points lower than pre-covid prices.

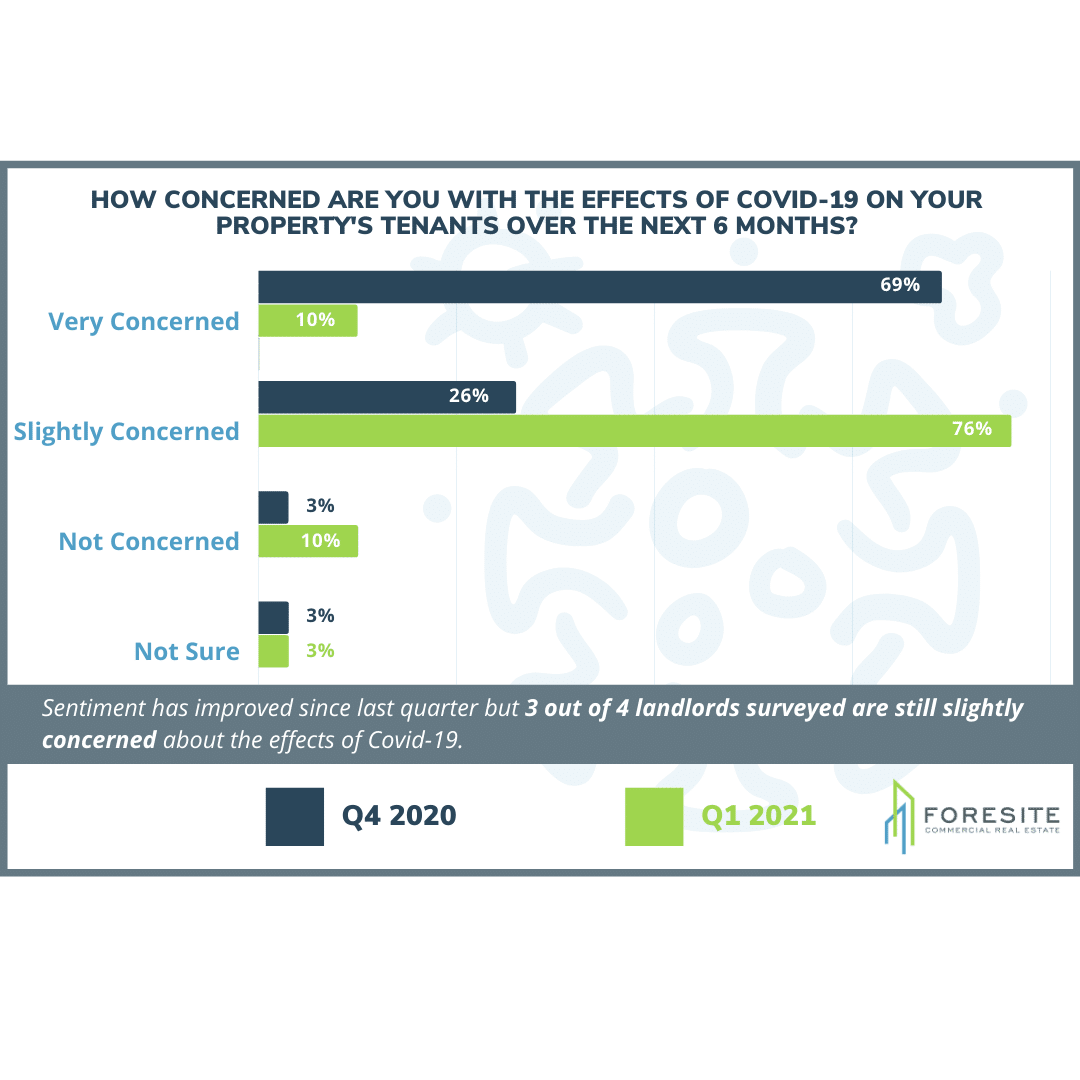

COVID-19 Impact

Investors were asked six months apart if they were concerned about their tenants’ performance over the next six months. The majority of respondents changed their answer from very concerned to slightly concerned.

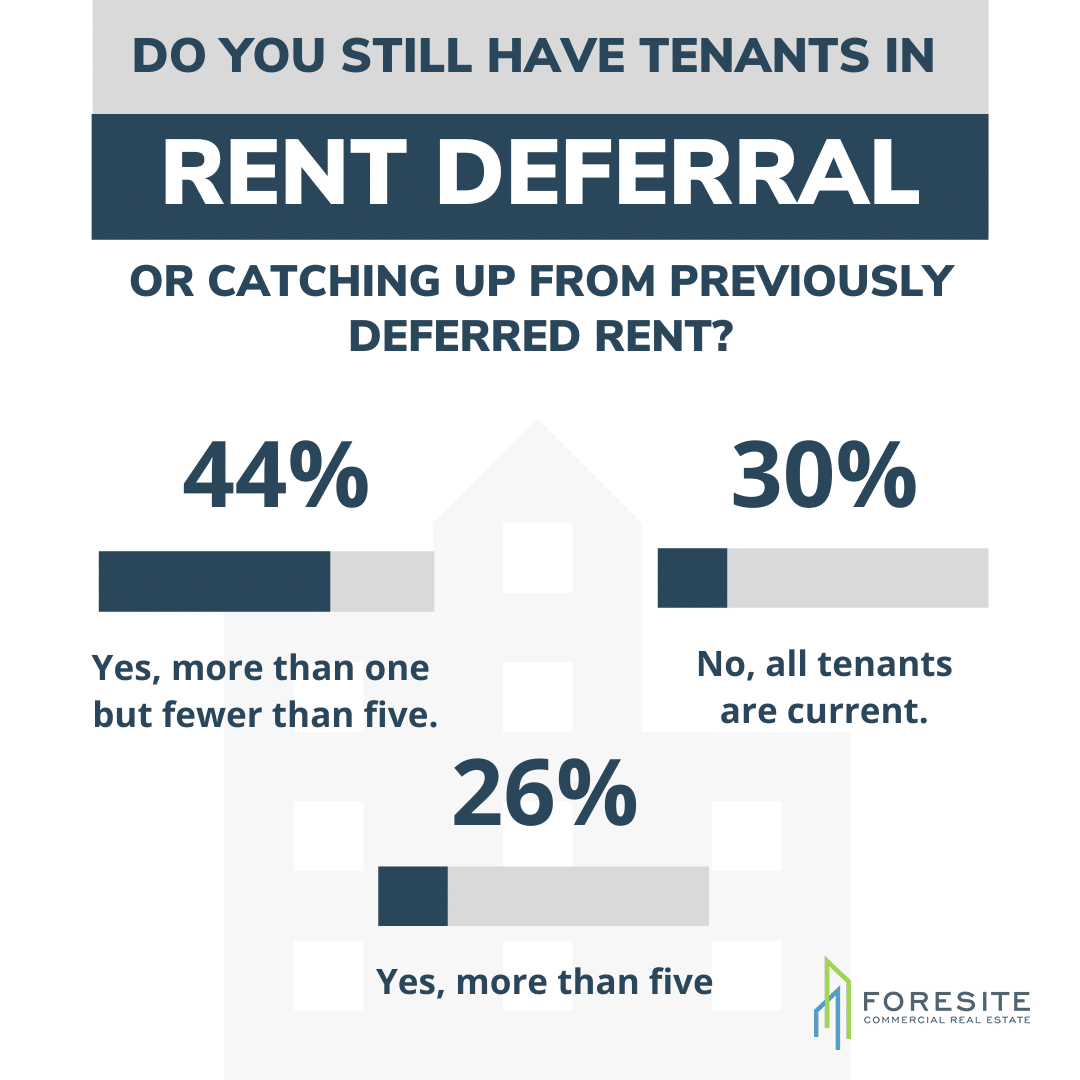

Every investor surveyed provided some form of rent relief during the pandemic. 30% of respondents have all their tenants current on rent and 26% still have more than five tenants deferring rent or catching up from previously deferred rent.

Investors continued their optimistic outlook on occupancy in retail centers. 26% of respondents forecast that vacancy rates will improve in the next six months. When asked their opinion six months ago, 20.5% of investors said that vacancy rates would increase significantly. That number is down to 4.3%.

Recovery

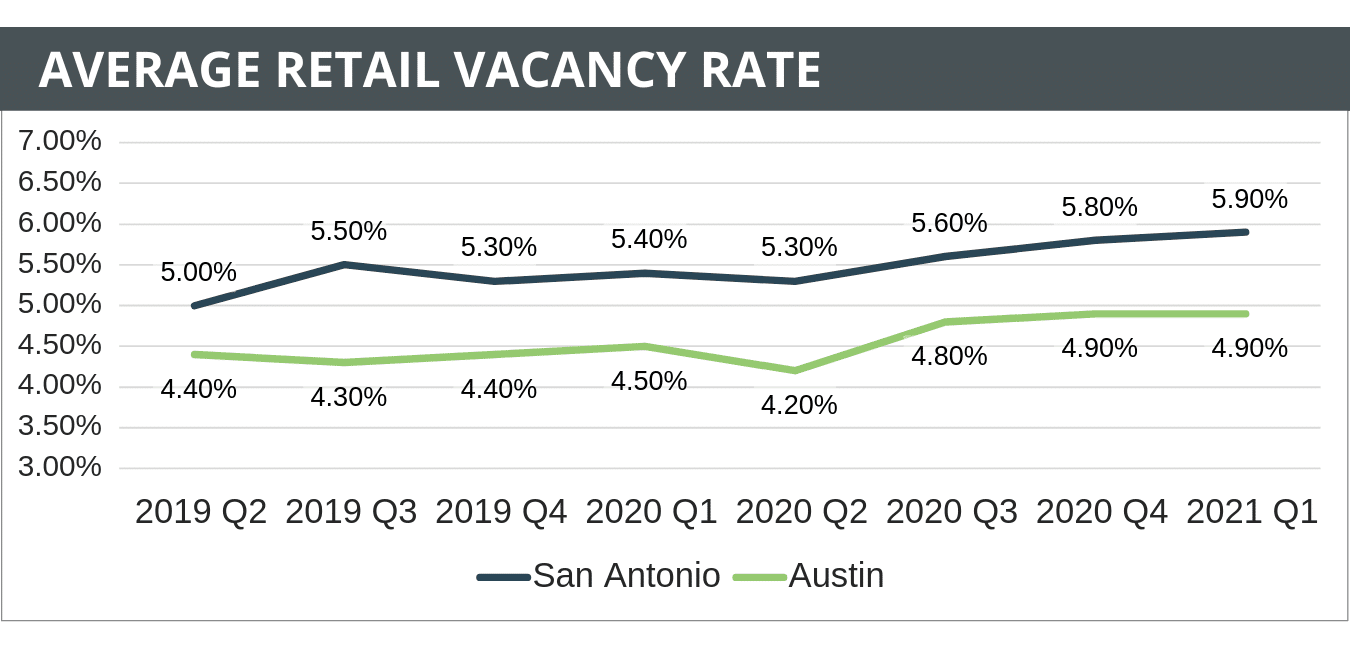

The retail market is expected to improve in 2021, especially as more of the population is vaccinated in the second half of the year. The average retail vacancy rate has slowly crept up over the last year but is not expected to continue the trend over 2021. The average vacancy rate in San Antonio is 5.90%, up 50 basis points from the same period last year. The average vacancy rate in Austin is 4.90%, up 40 basis points from the same period last year. Forecasts by the Texas A&M Real Estate Center do not expect the vacancy rate to change significantly over the next six months.