How Radio Shack Ruined Percentage Rents for Everybody

It should not serve as a means to finance a bad concept or a failing business that the landlord has no control…

How Radio Shack Ruined Percentage Rents for Everybody

Commercial leases with percentage rent clauses made up nearly a quarter of the LOI’s we received from tenants in the summer of 2020. It was the tenants’ attempt to transfer the risk of the uncertainty of the market to the landlord. It was an understandable approach considering the challenges of the market.

Tenants were quick to state they felt this structure was where the market was heading. They were insistent that landlords needed to come to terms and realize the new world in leasing would be short-term leases and rent set as a percentage of sales. Even with few options, landlords were still reluctant. Tenants were beside themselves wanting to get the deals done to meet their store count requirements but landlords didn’t budge. Why?

The unnamed partner.

The obvious answer is debt. Landlords are bound by a partner that tenants rarely have to deal with – the bank. The lender on the property often dictates the terms of the leases and even if they do not, a short-term percentage rent lease is not financeable. Commercial loans are rarely self-amortizing, and most have a balloon payment due at the end of the term. When the loan comes due, the property owner must refinance the remaining balance or find alternative financing, otherwise they risk losing the property altogether. Short-term leases and percentage leases increase the risk to the landlord and the lender, which reduces the property value, occasionally even more so than just having the vacancy.

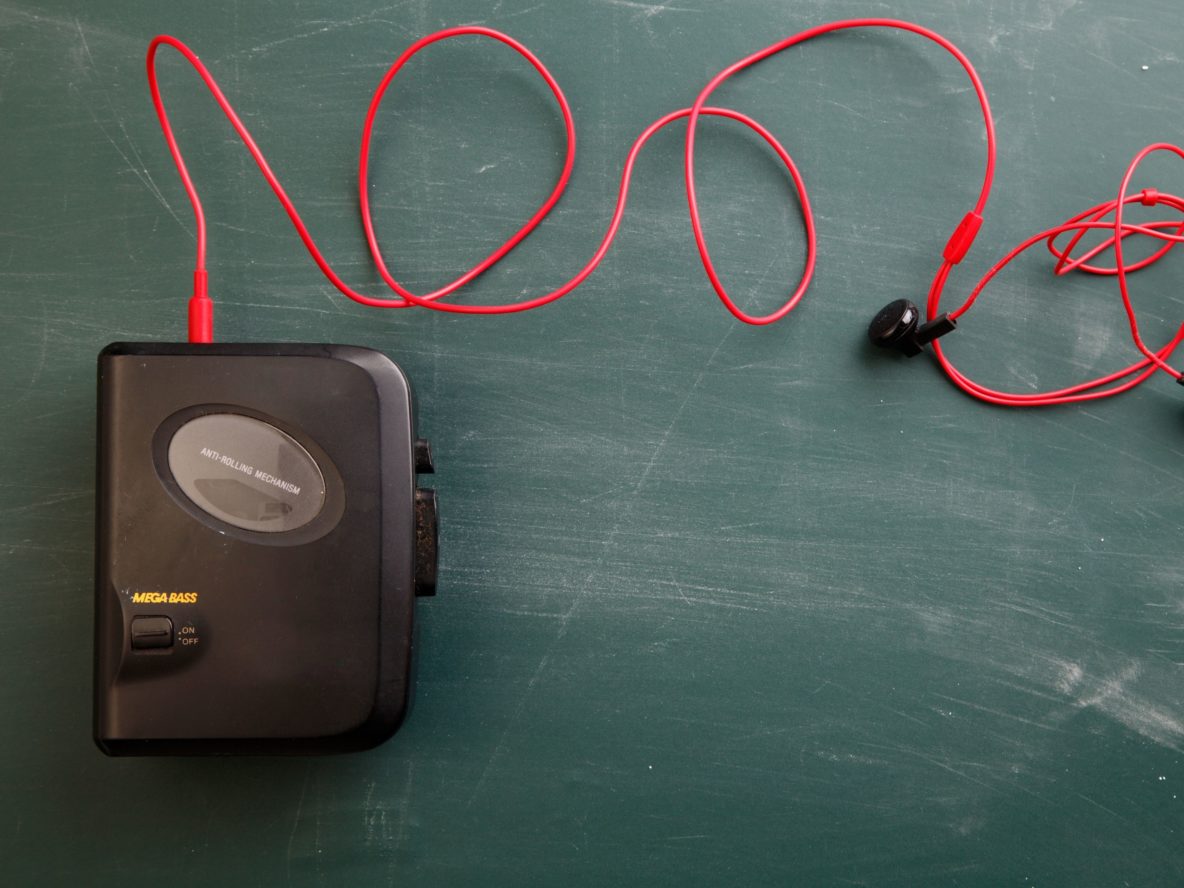

A lesser-known reason why landlords will not agree to percentage rent is because of the drawn-out and slow demise of Radio Shack. Remember them? The place that sold you walkmans and a TV antenna? They closed their last store in 2017. The bigger question is how did they survive as long as they did, especially in higher rent centers across from Walmarts and other major retailers? The answer is percentage rent clauses.

Testing the market or financing a start-up?

Radio Shack had shrewdly inserted percentage rent clauses in most of their leases. It contained language that seemed absurd at the time. “If sales drop below $300,000 a year, the tenant will pay ‘X’ percentage of sales as rent to the landlord.” Some contained higher sales minimums, some lower. The number was so low that many landlords just shook their heads thinking their locations would obviously never fall below that amount, and if they did, the tenant would close the location. Except they didn’t. Radio Shack didn’t just stay, they even exercised renewal options under those terms. Some of those renewal options exceeded the length of the original lease term. Radio Shack was paying so little rent that stores could be half-empty with virtually no inventory and one employee and still remain open. They used this clause to finance a failed business concept for nearly a decade.

Short Term Leases became long-term problems.

The result? Landlords could not remove the tenant who had no business being in business anymore, and the values of their properties dropped. There was nothing anyone could do about it.

Landlords don’t forget. Neither do their banks or their lawyers. That clause was burned in their memories as a tenant failed at no fault of the location or the landlord, yet the landlord was left with the biggest loss.

A Fair Approach

So if you are representing a tenant and you want to propose a lease with a percentage lease clause, a short-term lease deal, or both, remember the landlord’s perspective and opt to make it a short-term arrangement with limited renewal options. It should not serve as a means to finance a bad concept or a failing business that the landlord has no control over. This structure should be used to propose a testing ground for the tenant’s business to identify if it is a viable long-term business location.