2020 faced uncertainty in the commercial real estate market that will continue into 2021. Forecasting how the economy will recover is difficult, especially since this recession was caused by a health crisis and will not follow the recovery path of previous recessions.

To gain a better perspective from our network of professional retail property investors, Foresite Investment Sales conducted a survey during the 4th Quarter of 2020. The survey included active retail property investors and shopping center owners.

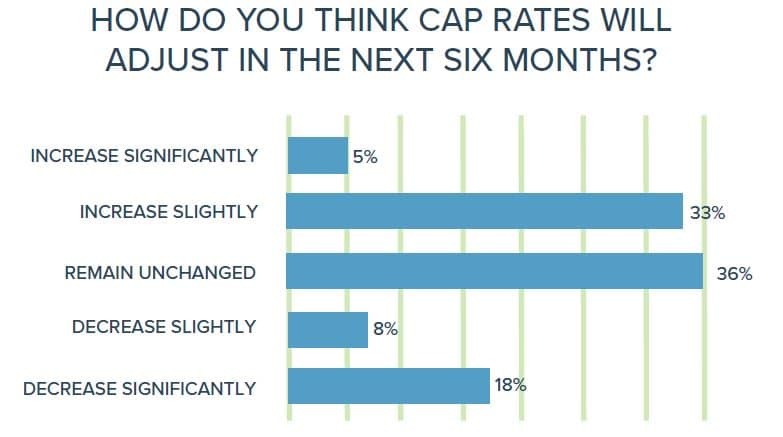

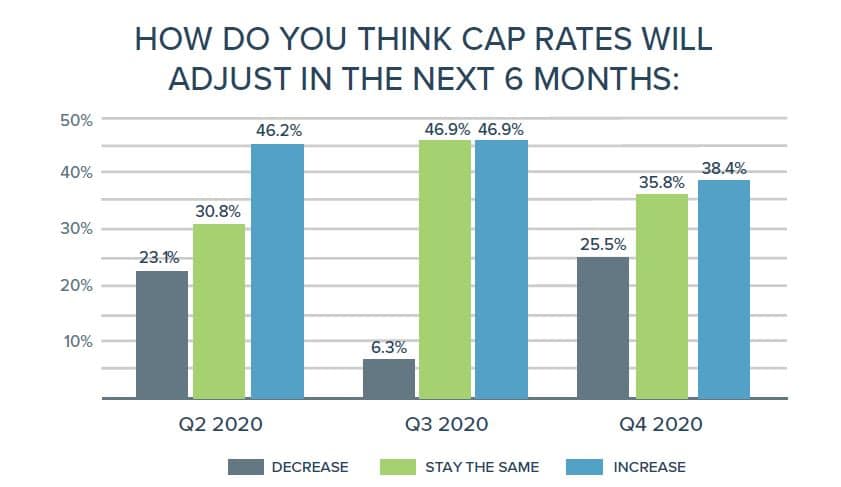

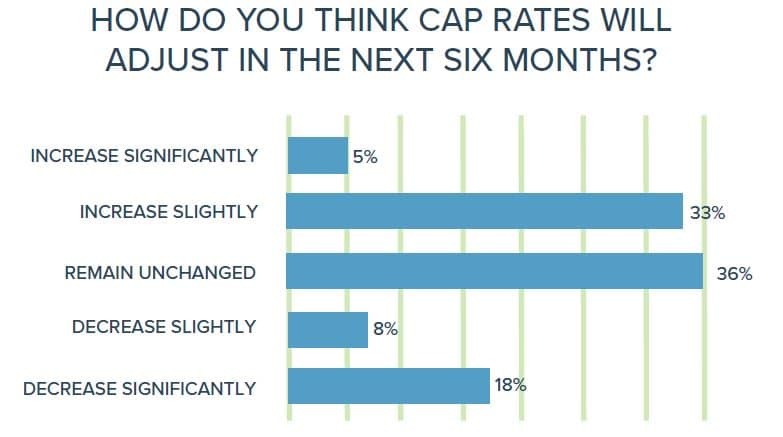

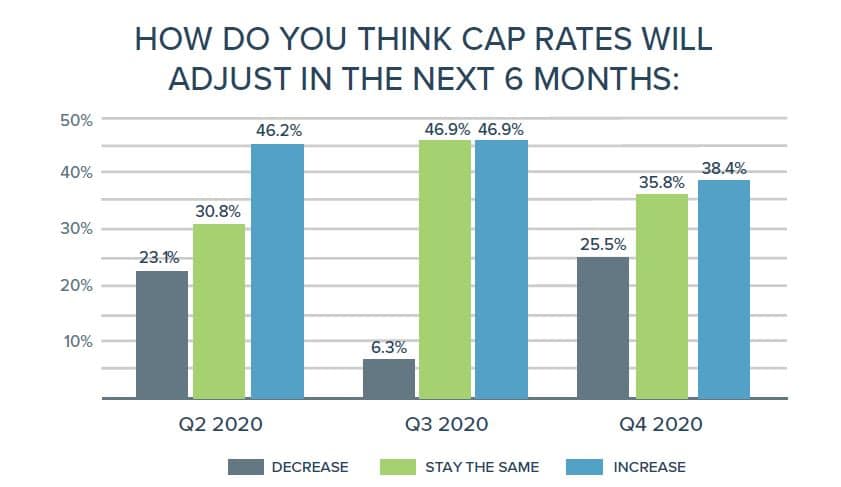

In every quarter, the majority of respondents believed that cap rates would hold steady at 2019 levels or that cap rates would start to increase. The respondents who believed cap rates would remain unchanged were significant in the third quarter, likely due to the slowdown in transaction activity as sellers held firm on pricing.

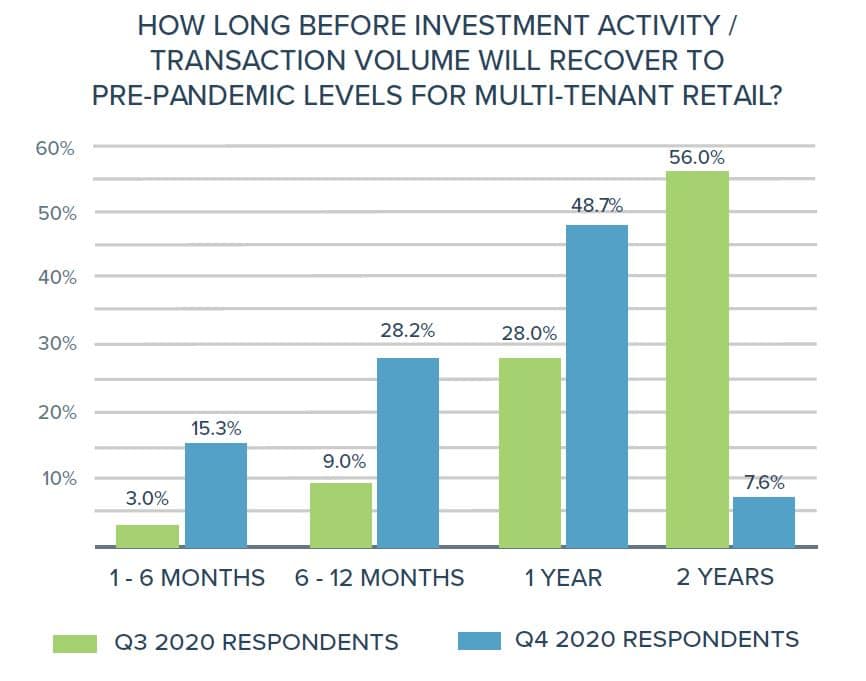

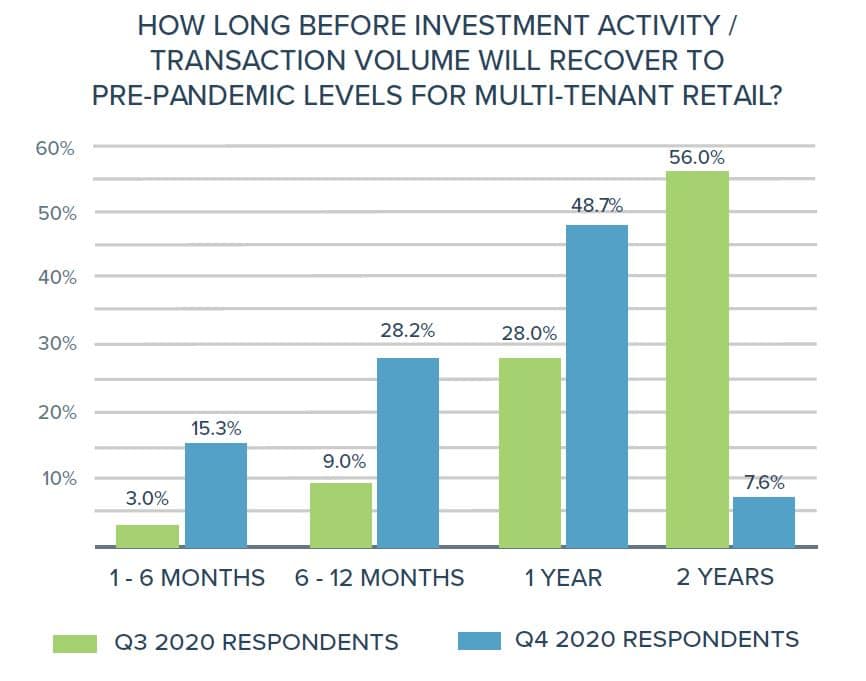

2020 saw lower transaction velocity in CRE both locally and nationally. The uncertainty caused by the pandemic created a slowed-down transaction environment as investors demanded a discount on pricing that sellers were not ready to give. There was not an influx of distressed properties offered for sale throughout the year as some investors expected. The increased risk of retail properties and sellers’ reluctance to lower prices created a significant bid/ask gap in the market. Cap rates for retail real estate have remained stable but transactions are down 50% nationally year-over-year according to Real Capital Analytics.

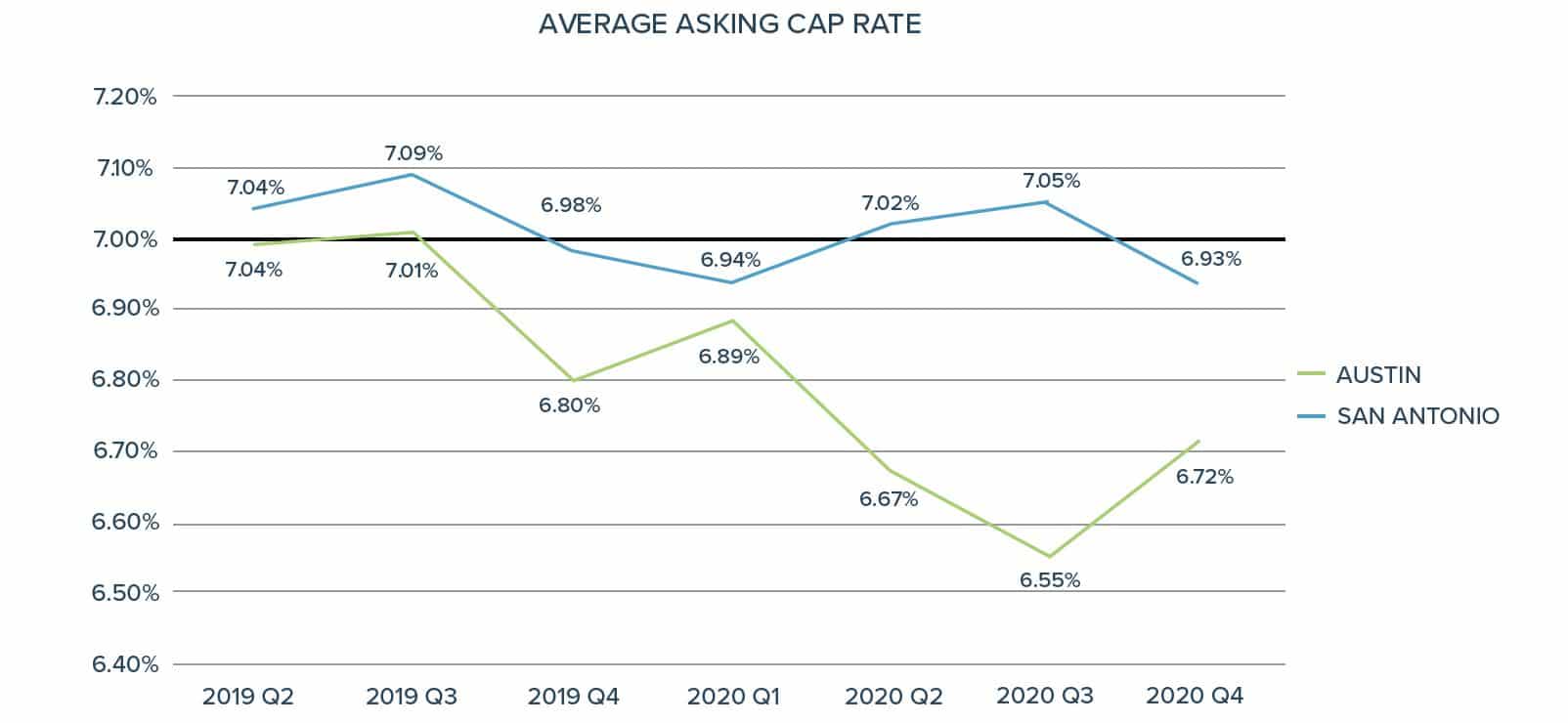

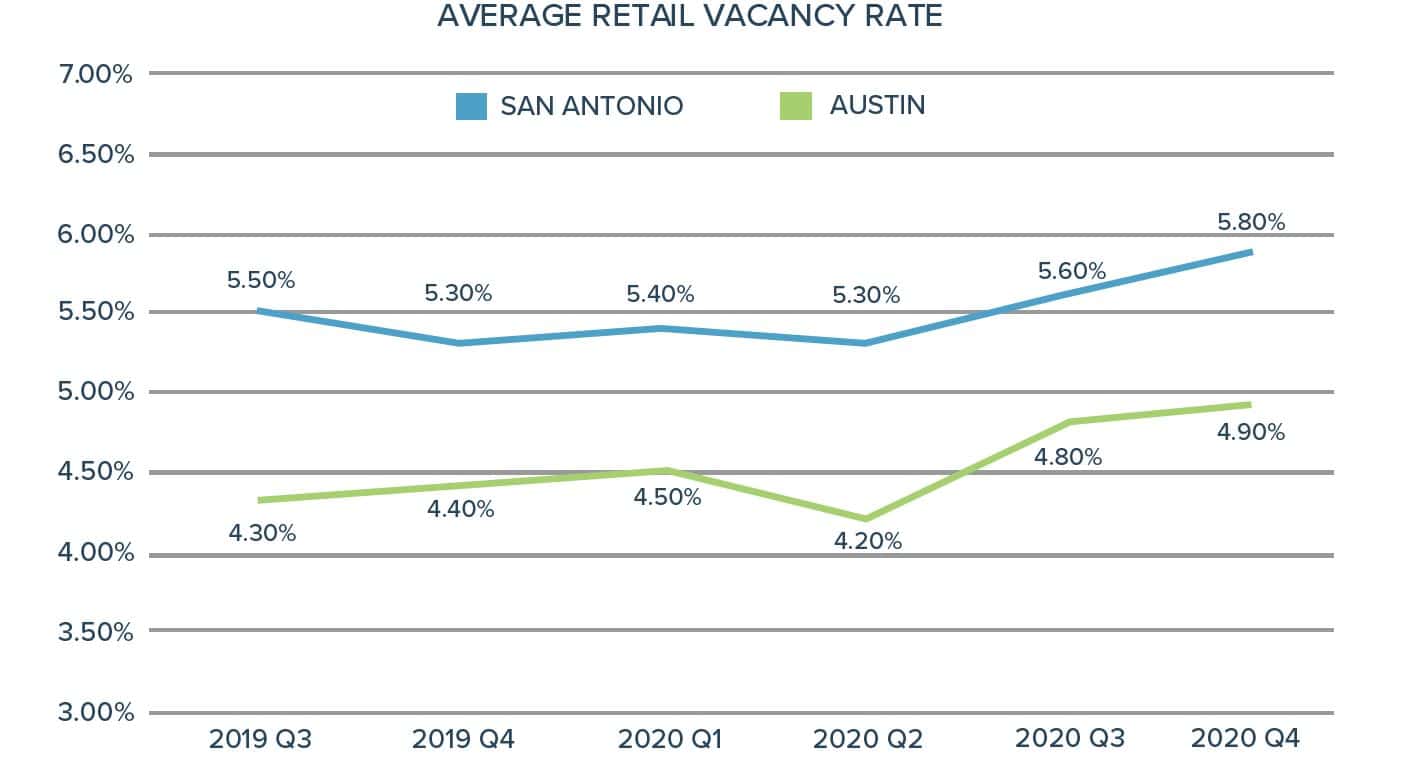

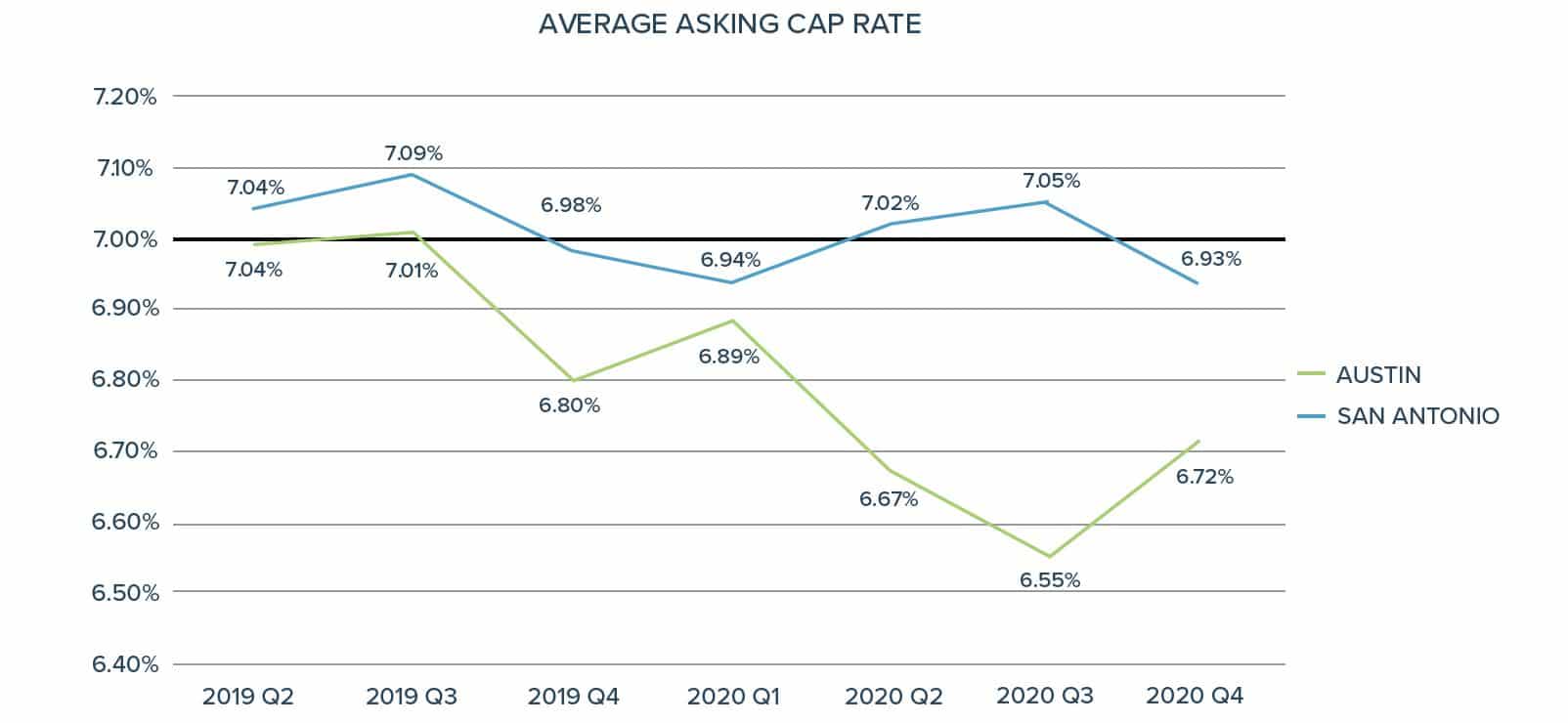

This graph shows the averages by quarter of the starting asking prices for new listings on the market. The asking cap rates between Austin and San Antonio listings were very close during 2019 and into 2020 until the pandemic hit at the end of Q1. In 2020, we saw the average cap rate follow 2019 trends in San Antonio while the average in Austin decreased over thirty basis points.

As far as the multi-tenant retail properties that closed in 2020 versus 2019, there was a slight increase of 18 basis points in the average cap rate for San Antonio and a decrease of 41 basis points for Austin.

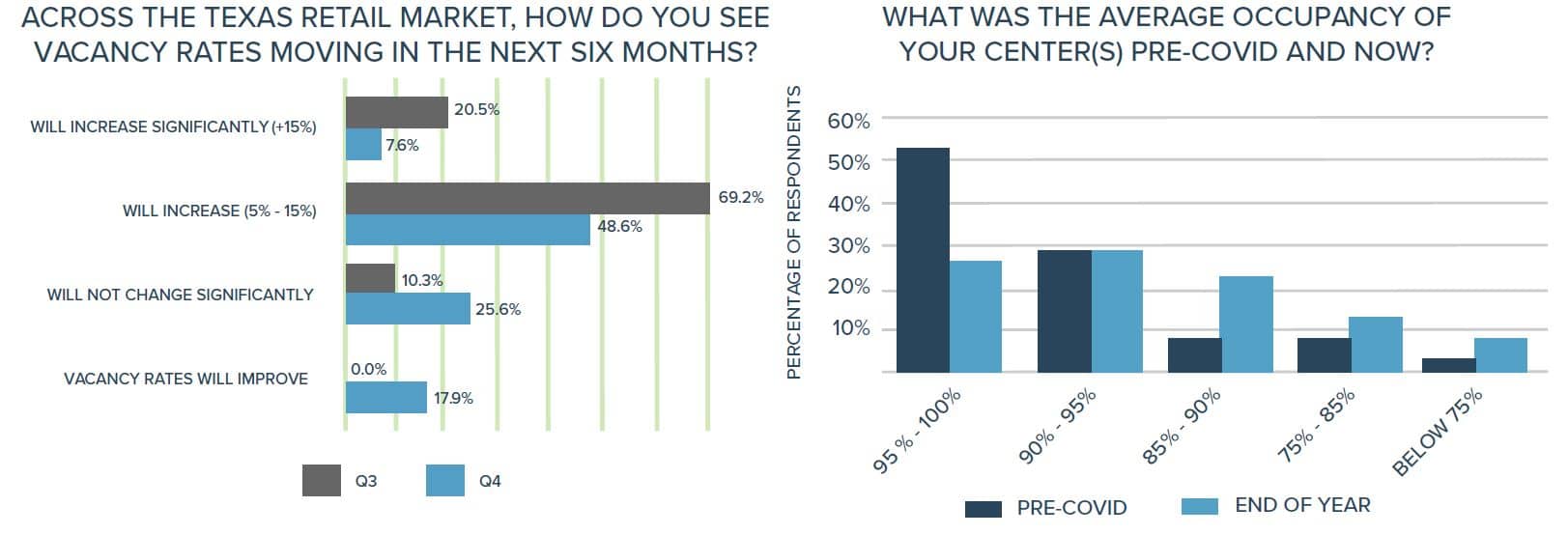

Investors were more optimistic about vacancy rates in Q4 with the number of respondents forecasting that vacancy rates will increase reduced from 89.7% to 56.2%. A quarter of respondents believe that vacancy rates will not change significantly in the next six months and 18% believe vacancy rates will improve.

Vacancy rates are expected to increase across the Texas market. The Texas Real Estate Research Center at Texas A&M forecasts Austin’s vacancy to moderately increase from 4.5% in 2019 to 4.9% in 2021. In San Antonio, 5.0 in 2019 to 5.9% in 2021.

TO READ FULL REPORT CLICK HERE

Subscribe for updates in your inbox

About the Author

Alexandria Tatem joined Foresite as an Investment Sales Associate and was quickly promoted to include Head of Research as one of her roles in addition to sales. She has a talent for sourcing data and compiling information in challenging markets. Alex is a graduate of the University of Central Arkansas, where she double-majored in Finance and Spanish. In college, Alexandria worked for the Arkansas Center for Research in Economics where she compiled data into clear and detailed reports. Her research has been used in testimonies to the state legislature, year-long studies, published reports, and informational booklets that were handed out to legislators. Alex is a member of the International Council of Shopping Centers, Urban Land Institute of San Antonio, and CREW San Antonio.