Multi-Tenant Retail Buyers Buy Local

For years, California buyers were considered the prime targets for San Antonio retail center sellers. But recent data tells a different story.

San Antonio multi-tenant retail investment closed deals data as of October 10, 2024. Collected by Xavier Alvarado.

Xavier Alvarado

Investment Sales Associate

Foresite Commercial Real Estate

For years, California buyers were considered the prime targets for sellers of multi-tenant retail centers in San Antonio. But recent data tells a different story. While many believe California buyers dominate the market, the reality is quite the opposite.

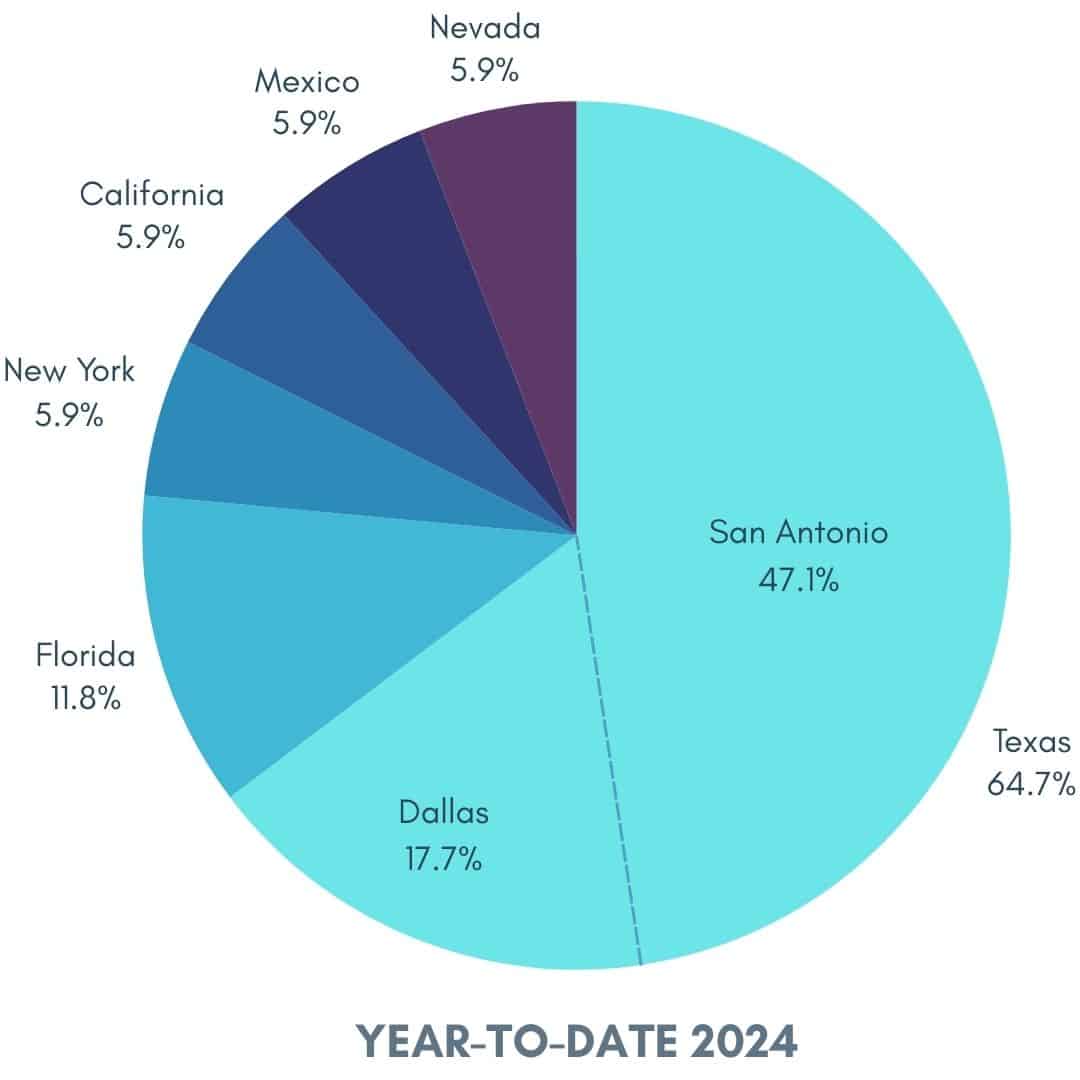

Year-to-date 2024: Out of the 17 multi-tenant retail center sales where buyer information was available: 64.7% of the buyers were based in Texas, with San Antonio accounting for 47% of those transactions followed by Dallas at 17.65%. Notably, there were no buyers from Austin or Houston. The out-of-state buyers represented only 35% of the market, including 11.76% from Florida, 5.88% each from New York and Mexico, and 11.76% from California.

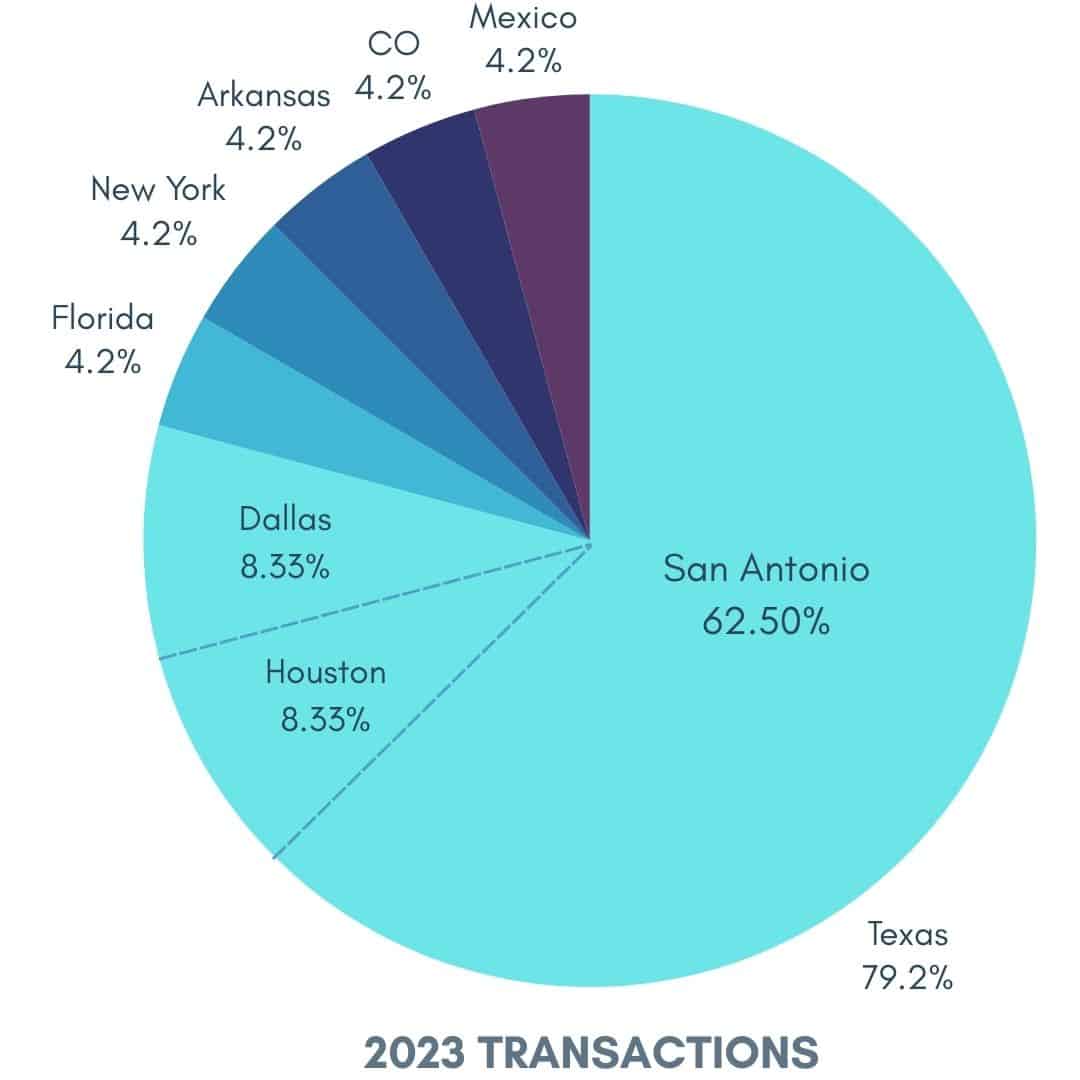

2023: Texas-based buyers made up 79.17% of all transactions, with San Antonio leading the way at 62.5%. Dallas and Houston each represented 8.33% with two transactions apiece. Meanwhile, out-of-state buyers only accounted for 20.83% of the total, with individual purchases coming from Florida, New York, Arkansas, Colorado, and Mexico.

2022: Following a post-COVID boom, Texas buyers once again dominated the market, representing 77.03% of the 74 transactions. San Antonio buyers led with 52%. Austin and Houston were notable contributors, each representing 9.33%, and Dallas at 5.33%. Out-of-state buyers accounted for 18.67% of transactions, with a significant mention of California at 9.33%. And Foresite proudly represented 5 of the 7 transactions from California buyers that year.

Despite the prevailing narrative, the San Antonio market is overwhelmingly driven by local buyers. Over the past two years, Texas investors have consistently comprised over 75% of the buyer pool, with California buyers representing 4.88% overall.

While national headlines and industry trends may emphasize the influence of out-of-state and California investors, understanding the actual data reveals where the real opportunities lie. This doesn’t mean ignoring out-of-state interest—it’s always wise to cast a wide net—but it does suggest a strategic advantage in partnering with brokers who have deep, established connections in Texas, and more importantly, in San Antonio.