The Investor's Guide to Commercial Real Estate

A comprehensive resource for investors

Time to Read: 90 minutes | Last Updated: November 2018

By: Bethany Babcock, MBA, Chad Knibbe, CCIM, Dr. Amit Mehta

Introduction to the Industry

Commercial Real Estate (CRE) impacts everyone in one way or another. From warehouses to apartments and shopping centers to office buildings, CRE is a large industry. Within the industry, there professionals and investors who choose to narrow their focus and expertise which can be a geographic area, or more commonly on a specific product type.

Due to the complexity and rapid changes in the industry, it is rare to see investors and professionals cover all product types. Most investors and professionals choose a limited number of product types and a specific sub-market. Others will narrow their focus to a specific single tenant building and broaden their market scope to be nationwide.

Many entrants to the market are drawn to the impressive returns and figures touted by high net worth individuals, but there are many who have had major losses. Those stories are not shared as often, but serve as an important caution for new investors. As professionals in commercial real estate, our goal in creating this guide is to improve the knowledge base of investors in our industry. It is our belief that an educated investor base is better for our market.

Product Types

While there are many subcategories, the primary types of commercial real estate products are:

- Office

- Industrial

- Retail

- Apartments

Other sub-categories include single tenant buildings and self storage. Single tenant buildings are typically retail buildings occupied by national tenants such as Walgreens, McDonald's, etc. but sometimes they are industrial or office buildings leased entirely by one entity. These types of buildings are their own product type due to their unique risk and reward profile.

Asset Classes

Typically you will hear investments labeled as Class A, B or C. These classifications are highly subjective and vary based on the submarket and product type.

In retail and multifamily it is not typically the age of the building that determines the class, rather the tenant line up in retail and the amenities in multifamily.

Occasionally a high quality construction retail project will be labeled as Class A irrespective of the particular tenants. Office and Industrial are often classified by a combination of its age and amenities. These labels can be very misleading as they do not reflect the risk profile of the investment.

Lease Types

Debt Structures in Commercial Real Estate

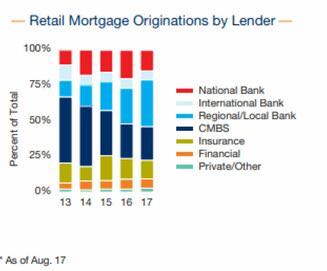

Debt for commercial real estate acquisitions can come from multiple sources ranging from traditional banks and credit unions, to insurance companies, to private individuals, to conduit lenders for securitized loan pools, to the US government to name a few.

Each type of debt capital has its own pros and cons and choosing the right route depends on your strategy for the asset. Will this be a long- or short-term hold? Are the principal borrowers able and willing to take on the personal recourse? Does the property have a reliable cash flow, or is redevelopment or re-tenanting necessary? Is high leverage or a low interest rate more beneficial to the borrower’s strategy or balance sheet?

Source: Marcus & Millichap

Banks & Credit Unions

The vast majority of debt is typically provided by local, state and national banks. Banks are typically relationship oriented and prefer to lend based on the merits of the relationship with the borrower rather than on the merits on the real estate. Due to this, banks are able to offer a higher leverage amount than insurance companies on transactions where they are dealing with a high net worth and highly liquid borrower with whom they have a relationship.

Banks charge moderate fee structures but do not charge a prepayment penalty in the event a borrower wants to refinance a loan or retire the note early.

Similar to asset classes, the classification of the type of lease varies between product type and submarket and carries different meanings. A NNN lease means something different in a multi tenant building than it does in a single tenant building and there are many variations of a gross lease. The true meaning of each and their impact on a property can only be determined by carefully reading each individual lease, every time. The list below highlights typical structures:

- The Ground Lease. The ground lease is one of the most self-explanatory classifications. The landowner leases the land to a tenant who typically builds at their own expense, a structure under a lease for anywhere between 10 and 100 years.

- The Leasehold. The counterpart to the ground lease is the leasehold interest which is the structure which was built on the ground lease. These interests can be traded independently of each other.

- The Full Service Gross Lease. The Full Service Gross lease is one in which the tenant pays rent and all risk of increased costs are passed to the landlord while the tenant pays a flat amount. These lease structures are becoming increasingly rare in spite of their simplicity due to the lack of their attractiveness to buyers and lenders of commercial real estate.

- The Modified Gross Lease. Similar to the full service gross lease, the modified gross lease requires the tenant to pay a flat amount with the exception of a service, such as utilities, which are passed through to the tenant.

- The NNN Lease (Multi -Tenant). The NNN Lease is favored among investors and lenders due to the ability of the landlord to share the risk of rising costs with the tenant mix. Tenants typically pay a flat amount plus additional rental which includes property taxes, property insurance, and common area operating expenses (The three N’s). Rather than have tenants pay their proportionate share of each and every bill as they come in, the leases provide for the landlord to estimate the total for the year and bill it back to the tenant monthly based on their square footage. At the end of the year, or at times during the year, the account is reconciled with the actual expenses and adjustments are made on either the tenant or the landlord side similar to an escrow account payment in a residential home. In these leases the landlord typically will only schedule and maintain the common areas and the roof of the property and the tenant arranges for repairs and maintenance of their own HVAC and repairs inside their suite.

It is important to note that not all multi tenant NNN leases are the same. Each tenant typically negotiates caps on the controllable expenses (excludes property taxes and insurance) and the amount of the management fee they will reimburse the owner for, etc. - The “Absolute” NNN Lease (Single - Tenant). The Absolute Single Tenant NNN lease requires the tenant to pay the landlord a set rate each month and all property taxes, insurance and maintenance expenses are paid and controlled by the tenant directly without landlord involvement. This is most common in buildings leased by national tenants such as KFC, Walmart, etc.

- The NNN Lease (Single - Tenant). Similar to the absolute NNN Lease for single tenants, the tenant absorbs both the costs and the responsibility for maintenance of the property but often times either property taxes or insurance is paid by the owner and reimbursed by the tenant

- The NN Lease (Single -Tenant).The NN Lease is often times seen in properties leased by tenants such as Family Dollar and usually exclude one or more expenses such as roof or parking lot maintenance requiring some involvement by the landlord.

Insurance Companies

Insurance Companies on the other hand, lend money through correspondents who source borrowers and underwrite potential loans for them. Unlike banks, Insurance companies are not relationship oriented and tend to make lending decisions based on the value of the real estate and security of its future income streams. Therefore, they typically do not lend money for vacant properties or heavy value-add projects.

However, because of their lower leverage and strict underwriting of the real estate, they are able to lend money for projects without requiring the borrower to personally guarantee the note. Debt from insurance companies typically comes with low interest rates and moderate loan origination fees, but require prepayment penalties for early retirement.

Agency Lenders

Agency lenders are banks and mortgage brokers who act as correspondents for government loan programs like the FNMA (Federal National Mortgage Association or Fannie-Mae). FNMA loans are exclusively for residential mortgages and therefore specifically multi-family acquisitions in the commercial real estate arena. The FNMA purchases notes with specific parameters from banks to create and ensure liquidity in the market so that banks can continue to provide loans on new mortgages.

These notes are have some of the most attractive terms in commercial real estate: low interest, high leverage, long amortizations and moderate upfront fees. The loans are typically guaranteed by the US government so personal recourse is not required.

Conduit Lenders

Although today it is a very small percentage of the commercial debt market today, CMBS (commercial mortgage backed securities) was the primary provider of lending for cash flowing properties before the market crash in late 2007. Also called CDOs (Collateralized Debt Obligations), CBMS loans are pools of loans on income producing properties that serve as the collateral for securities sold in the public exchanges. Ten-year terms, extended amortization periods of up to 30 years, no personal recourse, and aggressive interest rates made these loans very attractive to borrowers at the time.

The CMBS loans that exist today have many of the same characteristics, however the interest rates are no longer competitive with other lending options limiting the growth in this segment. The other significant disadvantages of CDOs are the inability to pre-pay the note early, and the heavy restrictions placed on the assets to protect the interests of the shareholders.

Private Lenders

One of the faster growing segments in the commercial lending arena are private lenders. These can be anyone from a high net worth individual or family offices, to a national non-banking organizations and investment funds formed exclusively for the purpose of providing lending on commercial assets. This segment started to grow beginning in the 2008 recession due to the limited availability of debt at the time.

With the ability to offer not only first lien debt, private lenders are filling in the gaps where the other debt alternatives do not venture. They offer loans for developments, un-stabilized properties, mezzanine debt, bridge financing, even participating equity up to 100% of project costs. The downside to these loans is the cost. Private lenders charge high origination fees, high interest rates, and occasionally require participation in back-end profits.

Seller Financing

There are certain rare occasions when the seller of a property has little to no debt against the property and is willing to provide seller financing. Most seller financing scenarios are short-term in nature, but occasionally a self-amortizing loan can be obtained at slightly above market interest rates. These opportunities are rare, but offer the borrower an attractive financing solution, with no appraisal or origination fees or pre-payment penalties.

Risks in Commercial Real Estate

The risks and levels of exposure to the risks in commercial real estate are numerous. There are many risks that are often underestimated and commonly ignored, yet others that are over emphasized. It is an investor’s ability to foresee, value, and mitigate those risks that will determine their success as an investor.

Some investors in an attempt to identify the safest possible investment end up exposing themselves to other risks that they did not foresee. Other investors, comfortably assume all sorts of varieties of risk, but price the risk profile into their acquisition cost. It is the ability to perform these calculations accurately and remain competitive in the buyer pool that presents the greatest challenge for most qualified investors in commercial real estate.

Often times, the buyers with the least amount of experience and knowledge of the risks are rewarded with the purchase of the property only to realize later they did not take into account risk that the rest of the buyer pool acknowledged.

It is important to note that the risks are subjective and dependent upon each investor's individual situation. A large family office with no debt may feel comfortable assuming a loan with a short term remaining on a single tenant building. In contrast, an individual investor using his or her retirement account to purchase a property could not price that risk in a manner to make themselves a competitive buyer for the asset.

Types of Risk in Commercial Real Estate

Vacancy Risk

The most straight forward risk in most investment real estate opportunities is the risk of vacancy.

Many investors focus on lease expiration, tenants' likelihood of renewal and the rental market when evaluating this risk. In addition to this, investors should also evaluate the tenant themselves and the risks they face in their business which ultimately are also shared by their landlord. These risks often impact the tenant’s ability to complete their lease terms.

Rollover Risk

When a tenant does vacate, a new factor must be evaluated: how long will it take to replace those rents and how much will it cost to replace them? It is not merely a factor of determining when a new tenant will come, but more importantly, can a similar quality tenant replace them? How much will the landlord be expected to contribute to tenant improvements? What are the leasing commissions in the submarket? Is the type of lease structure to be replaced still in use or has the market shifted?

These questions not only determine the cashflow, (or lack thereof) but the value of the building itself when the tenancy changes.

Culture Shift Risk

The risk of whether or not tenants will continue to lease large office spaces, visit traditional retailers, require a drive thru, or even use grocery stores are all risks shared by the landlord with the tenant base.

Investors must have a good understanding of their submarket and the direction it is heading while making assumptions to price in these risks.

Expense Increase Risk

For lease types that require the landlord to assume some or all of the risk of expenses of maintenance, the obvious risks include mechanical failure and damages. A greater risk, however, are issues outside of the landlord’s control known as “uncontrollable risks.” These include property taxes and property insurance.

These types of factors which are outside of the landlord’s direct control impact the profit, or absence thereof. It is for this reason, the market is shifting with a strong preference towards lease structures which require tenants to share in these risks.

Interest Rate Risk

At various times throughout history, variable interest rates have gained or lost appeal. These types of loans deploy the risk of increasing interest rates onto the investor.

A property with short term leases and a strong rental market can respond to this risk more easily than a property with long term leases (or even short term leases with a weak leasing market.)

Refinance Risk

As mentioned before, commercial loan terms are not typically self amortizing. This is due to the size and thus the exposure of a bank to interest rate fluctuations. Typical lending institutions will provide terms between 3 and 10 years which means many investors will have to take on a refinance at some point during their hold period.

Investors must attempt to make realistic assumptions about not only the future of interest rates at the end of the term, but the value of their property and the amount of leverage given on a new loan against that new value.

Market Shift Risks

Crime, traffic and even stop lights can impact the performance of a commercial property and its ability to command rents. There are a set of other factors to consider that impact rents in a submarket including competitive properties that could be constructed during the hold period that potentially could drive rents downward.

Co-Tenancy Risks

Typical in power center shopping centers which are anchored by major retailers, smaller retailers usually demand a co-tenancy clause. A co-tenancy clause can allow a tenant to either vacate or operate at a reduced rent in order in the event of the anchor leaving the center.

Other variations of this are occupancy clauses allowing similar relief if the occupancy of the center drops significantly.

Legislative Risks

Legislative risks are typically focused on a particular tenant. Examples of this are gun stores, liquor stores, payday lenders etc. Many of these tenants have clauses in their lease that allow them to vacate should the legislature pass a law preventing them from continuing normal operations.

Other Risks

It is also important to note that some product types, such as retail, are not able to respond to changes in a submarket by reducing rent as easily as other product types. That is due to the heavy investment retailers place in their locations related to the rent they pay. In short, the wrong location is the wrong location even if it's free for a retailer who needs just the right access, co tenancy, etc.

Benefits of Investing in Commercial Real Estate

With all the risks above and many others, it can seem impossible to successfully navigate the investment market. With skilled advisors and prudence, however, many investors find they prefer commercial real estate to other forms of investing. A few of the reasons are listed below:

Tax Advantages

Today’s IRS rules allow investors to write off the depreciation of improvements made to a property . This results in a tax favorable outcome to an investor while the property is still increasing in value. In this scenario, the actual improvements are written off from a tax perspective over the course of 31.5 years. This tax benefit offsets the cash received from the property which serves to improve the investors after tax returns. Many investors practice what is known as cost - segregation which allows investors to separate individual components of the property such as HVAC and depreciate them on a shorter schedule further improving the benefit.

Additionally, many ownership structures allow the increased value of the property to be carried through what is known as a 1031 exchange into another property or properties upon the sale and delay the tax payment on that increase in value.

Stability

While traditional securities can vary in value by the minute, changes in commercial real estate occur over a much longer period. This allows investors to respond and adjust their strategy accordingly. Long lease terms, strong tenant mixes, long term or no debt at all can all improve the stability of the investors position in commercial real estate. There are few other investment vehicles which can offer investors this kind of lead time and also opportunity to modify their investment strategy while changes occur.

Diversification

Another great benefit to investing in commercial real estate is diversification. While there are events that can negatively impact the entire market, there are specific asset types which respond differently to the various risks. A diverse portfolio can withstand many of the risks associated with the market and position an investor to be more competitive in purchasing additional assets as their global risk profile may vary from that of an investor with a focus on a particular asset type.

Higher Returns

The primary reason most investors choose commercial real estate is its overall performance versus the general stock market. The volatility of the market as well as the overall returns fair better for investors in commercial real estate over the stock market when looking at the 10 year and 20 year averages.

Calculating Commercial Real Estate Returns

The returns in commercial real estate are just as challenging to identify as the risks.

There is a wide variation in the quality of the underwriting of these opportunities which directly impacts the reliability of the stated return. There is little standardization as underwriting techniques vary by submarket and market conditions. Additionally, It is not uncommon that the same property at the same point in time be underwritten with advertised returns varying by more than 200 basis points. Most of that variation is due to the differentiation between buyers assessments of the income stream and their ability or failure to account properly for the expenses. This is one of the most surprising aspects of the industry to new investors.

The Capitalization (CAP) Rate

The most simplified and yet flawed system of evaluating the price of a commercial property is the CAP rate. It is essentially the anticipated (not historical) return of the property not taking into consideration debt. It could also be seen as what the return would be if the property were purchased all cash and before taxes.

The formula for this is Net Operating Income Divided by the CAP Rate equal the value of the property.

Net Operating Income / Cap Rate = Value

The variations in value using this model, occur because investors vary in the manner that they determine the Net Operating Income. Some include current rent (even if a tenant is about to vacate), while others underwrite a rental increase which is scheduled, but not realized. . Other underwriting scenarios even assume tenants will reimburse for expenses that they are unlikely to actually reimburse (such as a tenant who is behind on rent is not able to actually reimburse the owner for the increase in property taxes).

The variations in value using this model, occur because investors vary in the manner that they determine the Net Operating Income. Some include current rent (even if a tenant is about to vacate), while others underwrite a rental increase which is scheduled, but not realized. . Other underwriting scenarios even assume tenants will reimburse for expenses that they are unlikely to actually reimburse (such as a tenant who is behind on rent is not able to actually reimburse the owner for the increase in property taxes).

Nonetheless, despite the flaws, the CAP rate is the primary valuation model for most of the commercial real estate investment community.

How is a CAP Rate determined?

The cap rate is essentially a return for risk and it determined by the markets appetite for that risk. It varies and is a compilation of all the risks detailed above as well as individual investors situations.

The Internal Rate of Return (IRR)

The IRR is a more accurate view of a true return taking into consideration a myriad of circumstances during a proposed hold period. The biggest challenge to the calculation of the IRR is is the assumption of a sale price. It is this assumption that carries the biggest weight in the calculation and as such, can be grossly overstated by an optimistic investor or real estate professional. The IRR is essentially a discounted cash flow.

The Net Present Value (NPV)

The Net Present Value (NPV) is not typically used in the evaluation of commercial real estate. In simplified terms, the NPV discounts the anticipated cash flows based on the minimum required return required by the investor. Generally speaking, after discounting the future cash flows according to that rate, if the project shows a positive net present value it is worth considering.

Cash on Cash

The Cash on Cash return is essentially the relationship between the cash invested and the cash received in a given year. This is one of the more common methods of calculating a return. It too, however, can be misconstrued by showing a high year one cash on cash return when it is apparent that a large vacancy or other change looms just around the corner. It is important to evaluate and attempt to project the cash on cash returns in each year within the hold period.

How to Start Investing in Commercial Real Estate

In the past, successful investors in commercial real estate came from a legacy scenario in which knowledge and assets are shared through generations. A second means of entering the market would be through real estate professionals such as brokers who were able to leverage their industry knowledge to source and procure opportunities for themselves and their partners.

Occasionally equity opportunities would be available to those closest to the deal makers based on the equity needs of the particular projects. These opportunities were typically kept within a tight network due to constraints in advertising as required by the Securities and Exchange Commission.

The SEC rules have changed in recent years. These new rules now have loosened restrictions in the investment industry to allow general advertising for commercial real estate opportunities. This enables a larger portion of the market to access investments in commercial real estate. Most of these opportunities still require investors to be considered Qualified Investors as defined by the IRS. The logic behind this rule to is prevent uninformed investors from navigating into an unregulated securities offering environment.

Additional opportunities made available through the rule changes provide for regulation D offerings that are available to the general public investing smaller quantities. This is commonly known as crowdfunding.

It is important to note that it is estimated that more than 80% of all commercial real estate investments involve a partnership in some form. This is due to the large capital requirements needed both initially and over the holding period.

For those investors determined to enter investment real estate without partners, the smaller deals are usually no less than $1,000,000. The lending environment, while constantly evolving, customarily will only provide debt funding for 70% of the value of the asset being purchased. Therefore, typical initial investments in commercial real estate of even the smallest sizes are between $300,000 and $500,000 for just the down payment. Additionally, banks typically require a balance sheet that demonstrates that net worth of the borrower is at least equal to the value of total asset. It is also important to note that due to the smaller purchase price, the demand, and thus the returns for assets that fall into this category are generally lower than those of similar risk profiles with higher capital requirements (supply and demand)

Investors who do not have a million dollars in purchasing power typically opt to invest with partners. Even with substantial purchasing power will often join partnerships as a means to diversify their risk across several assets.

Crowdfunding sites have made identifying and funding opportunities much more accessible for these investors in recent years. Extreme caution should be used with these methods as the underwriting and the advertising is done by individuals with varying sets of experience and skill set and the industry is largely unregulated with little consistency.

The success of commercial real estate funds are not dependent on the advertised returns or even the historical returns (as the methods used to calculate those returns is highly subjective). The funds success is very much dependent on the background and experience of the fund executives and the asset management team in place.

Like what you read? Subscribe to recevie industry articles and resources like this.